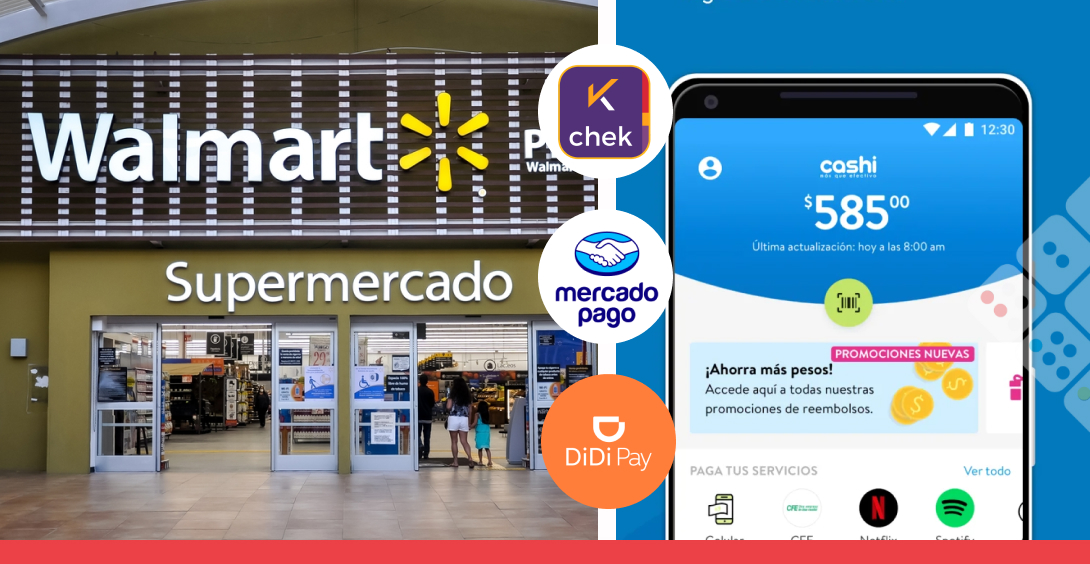

Update – Will everything become fintech? Companies that branched into finance

.

Accede al análisis que impulsa la toma de decisiones en la banca latinoamericana

Este contenido exclusivo está disponible solo para miembros registrados de iupana.

Regístrate gratis o inicia sesión para leer el artículo completo y descubrir:

Perspectivas estratégicas sobre innovación, regulación y tendencias en banca digital y fintech

Entrevistas con líderes que están transformando el sector financiero en la región

Reportes y estudios que anticipan los cambios clave del mercado

Acceso prioritario a información para tomar decisiones informadas y fortalecer tu liderazgo

Únete a la comunidad de ejecutivos que marcan la diferencia en la transformación digital de la banca.