.

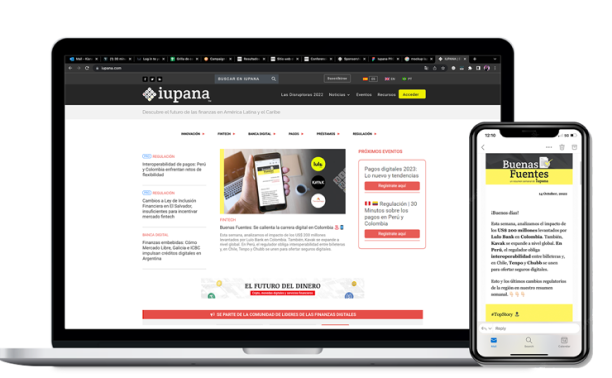

Latin America´s digital banking, fintech and payments leaders turn to iupana for hight value market information.

75% of our readers influence the purchasing decisions for their company.

50% of readers made a professional decision thanks to the information provided by iupana in the last 12 months.

87% of readers say iupana helps them "a lot" to keep abreast of developments in digital finance.

Reach Latin America's financial services decision makers through iupana

Let's help financial innovation flourish, together.

Download our media kit to learn more about our audience, and how we can help grow your business in Latin America’s digital finance industry

iupana explains industry changes and sparks relevant conversations - and above all, we share robust, high value market intel with Latin America’s financial services innovators.

Our award-winning reporting helps industry leaders make sense of

the pace of change – and inform their business strategy.

News and analysis

Special downloadable reports

Email newsletters

Our live events are engaging and interactive, and help senior executives make meaningful

professional connections.

Digital events feature industry leaders to discuss new trends with our audience across Latin America

Executive roundtables bring together curated invitees for premium thought leadership

Position your brand right where banking, fintech and payments leaders are looking for answers.

Join the conversation to connect with high-quality leads, new prospects and clients.

Ready to learn more?

Download our Media Kit to find out more about sponsorship opportunities with iupana

Take a look at our latest coverage in Spanish:

And our latest coverage in Portuguese:

Or look back on our archive of English-language content: