Digital channels

Credicorp’s Tenpo sticks to neobank plan despite sluggish economy

The fintech, which aims to become Chile’s first neobank, will move a step closer to that goal in the coming days with a license to issue credit cards…

Navigating the headwinds: Fintechs see risk indicators rise

We analyze the challenges facing credit fintechs in the region….

Banking as a Service in Latin America: Three current use cases

Companies from sectors as varied as clean energy and accounting have added financial products to their offerings to diversify revenue streams and strengthen customer loyalty…

A “game changer” for the Mexican market: Walmart dives deeper into finance

The country’s largest retail chain lays out plans to leverage its experience as a retailer to give its Cashi wallet an edge over its competitors in a fast-moving market…

Through embedded finance, Argentine banks and fintechs see increasing digital lending growth

ICBC, Galicia and Mercado Libre say marketplaces offer strong opportunities for digital lending – but warn that risk models can slow down the pace of approvals…

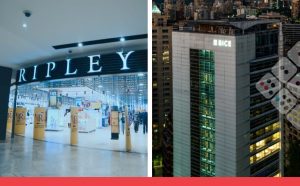

Financial supermarkets in Chile: Ripley tests remittances and Bice microcredit

Executives from Chek and Go Bice explain how these digital platforms have leveraged their parent banks’ product offerings and other advantages of being part of financial group…

The most-used digital wallets in LatAm

Digital wallets are gaining users across Latin America. Here are the 8 LatAm digital wallets with 10 million+ registered users in the region…

Data, UX and profitability: How Colombian banks seek to personalize digital finance

A panel of experts comprised of executives from Veritran, ADL Digital Lab, Scotiabank Colpatria, Ualá and Davivienda Corredores explain how companies can pivot towards prioritizing customer preferences and putting them at the center …

BNPL in Brazil, a motor for financial inclusion (and competition)

New entrants say 100 million Brazilians could benefit from payment in installments – and that Buy Now, Pay Later is gaining ground among SMEs…

The future of digital identity is multifactorial

As financial systems digitalize, so do attempts to compromise transactions…