Slow UX could hurt Mexico’s CoDi payments system

Esta información es exclusiva para los

miembros de iupanaPRO

¿Aún no eres PRO? Apúntate en la lista de espera para hacerte

miembro. Nuestro próximo onboarding es en agosto

¿Ya eres PRO? Iniciar sesión

¿Qué es iupanaPRO?

iupanaPRO es una plataforma de información exclusiva, eventos y networking para las empresas que quieren diseñar y ejecutar las mejores estrategias de negocio en el sector financiero.

Con iupanaPRO, las empresas tienen información a la mano, verificada, confiable y completa, sobre los cambios regulatorios en fintech, banca y pagos de América Latina.

iupanaPRO te explica —antes que los demás— cómo los cambios regulatorios impactan tus negocios y tus clientes.

Todos los dias

Noticias y análisis:

Siempre disponibles

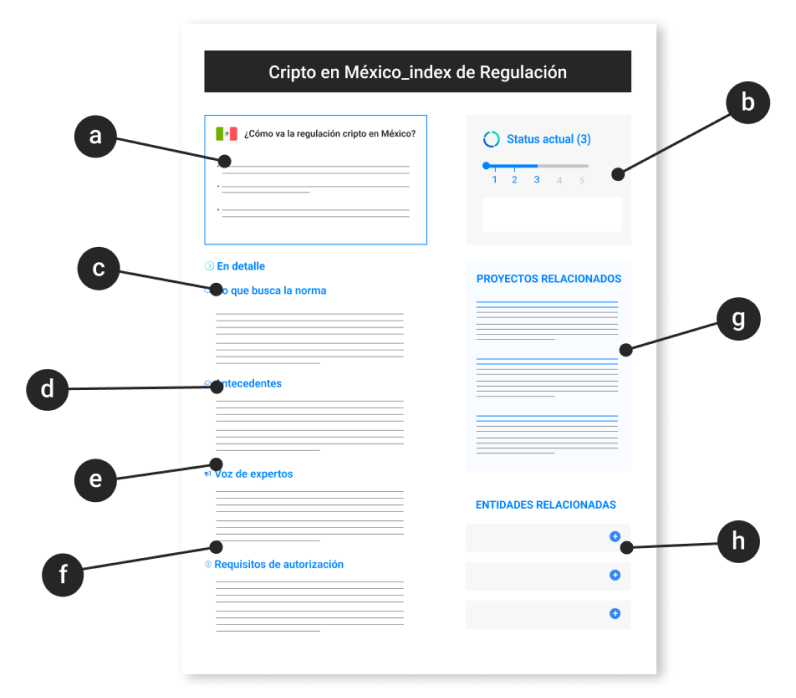

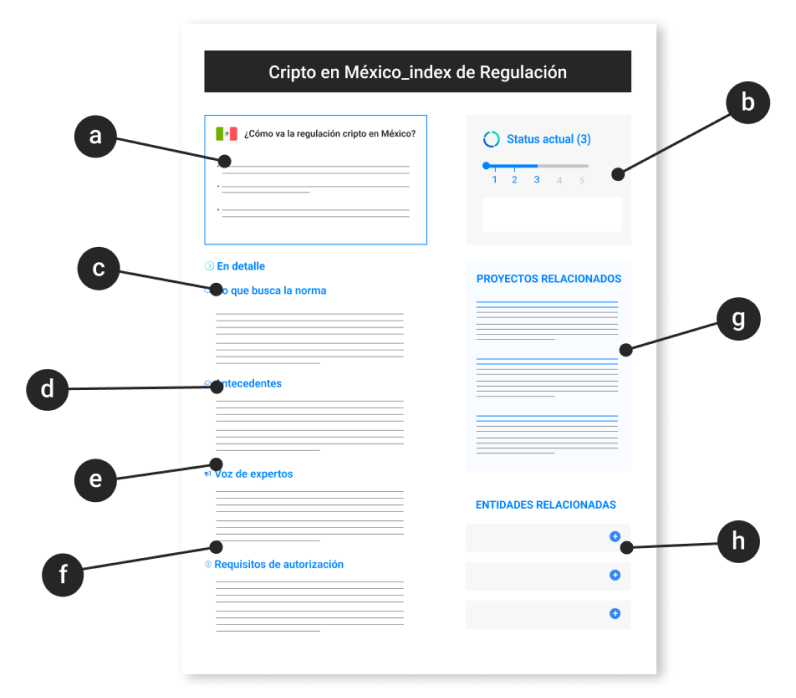

_index regulatorios: Datos esenciales y confiables sobre el estado regulatorio de las 6 áreas de política pública fintech en los principales países de la región.

![]()

a. Resumen de la regulación

b. Indicador que cuantifica del 1 al 5 el avance normativo oficial

c. Detalles sobre lo que busca la norma

d. Detalles sobre los antecedentes

e. Análisis de expertos sobre los avances regulatorios

f. Requisitos de autorización (algunos index)

g. Enlaces a los documentos oficiales como proyectos y anteproyectos de ley

h. Datos sobre las entidades regulatorias que tienen responsabilidad para esa regulación

Todos los miércoles

Boletín Pro:

Entrevistas exclusivas, análisis originales y alertas, directamente en tu inbox. Para que ningún cambio te tome por sorpresa.

.

Alertas y actualizaciones

Grupo de Whatsapp: Recibe alertas informativas, haz networking, resuelve tus preguntas y mantente al día con noticias y comentarios.

Recibe alertas informativas, haz networking, resuelve tus preguntas y mantente al día con noticias y comentarios.

Esta información es exclusiva para los

miembros de iupanaPRO

¿Aún no eres PRO? Apúntate en la lista de espera para hacerte

miembro. Nuestro próximo onboarding es en agosto

¿Ya eres PRO? Iniciar sesión

¿Qué es iupanaPRO?

iupanaPRO es una plataforma de información exclusiva, eventos y networking para las empresas que quieren diseñar y ejecutar las mejores estrategias de negocio en el sector financiero.

Con iupanaPRO, las empresas tienen información a la mano, verificada, confiable y completa, sobre los cambios regulatorios en fintech, banca y pagos de América Latina.

iupanaPRO te explica —antes que los demás— cómo los cambios regulatorios impactan tus negocios y tus clientes.

Todos los días

Noticias y análisis:

Siempre disponibles

_index regulatorios: Datos esenciales y confiables sobre el estado regulatorio de las 6 áreas de política pública fintech en los principales países de la región.

![]()

a. Resumen de la regulación

b. Indicador que cuantifica del 1 al 5 el avance normativo oficial

c. Detalles sobre lo que busca la norma

d. Detalles sobre los antecedentes

e. Análisis de expertos sobre los avances regulatorios

f. Requisitos de autorización (algunos index)

g. Enlaces a los documentos oficiales como proyectos y anteproyectos de ley

h. Datos sobre las entidades regulatorias que tienen responsabilidad para esa regulación

Todos los miércoles

Boletín Pro:

Con el resumen de lo más

relevante de la semana y

entregas especiales.

.

Alertas y actualizaciones

Grupo de Whatsapp: Recibe alertas informativas, haz networking, resuelve tus preguntas y mantente al día con noticias y comentarios.

Recibe alertas informativas, haz networking, resuelve tus preguntas y mantente al día con noticias y comentarios.